In this golden age of technology, we are witnessing technical marvels and incredible breakthroughs practically every day. Devices are getting faster and more efficient than ever before, machine learning is able to uncover trends that were invisible just years and decades ago, and artificial intelligence has become a popular tool to create stunning artwork.

Such rapid and consistent growth rarely goes unchecked, however, and in the age of crypto, this sustained technological boom may very well meet its match. A loose paraphrase of Newton’s third law could be, “what goes up must come down.” When it comes to growth in tech, though, the limiting law goes by another name: Moore.

What is Moore’s Second Law?

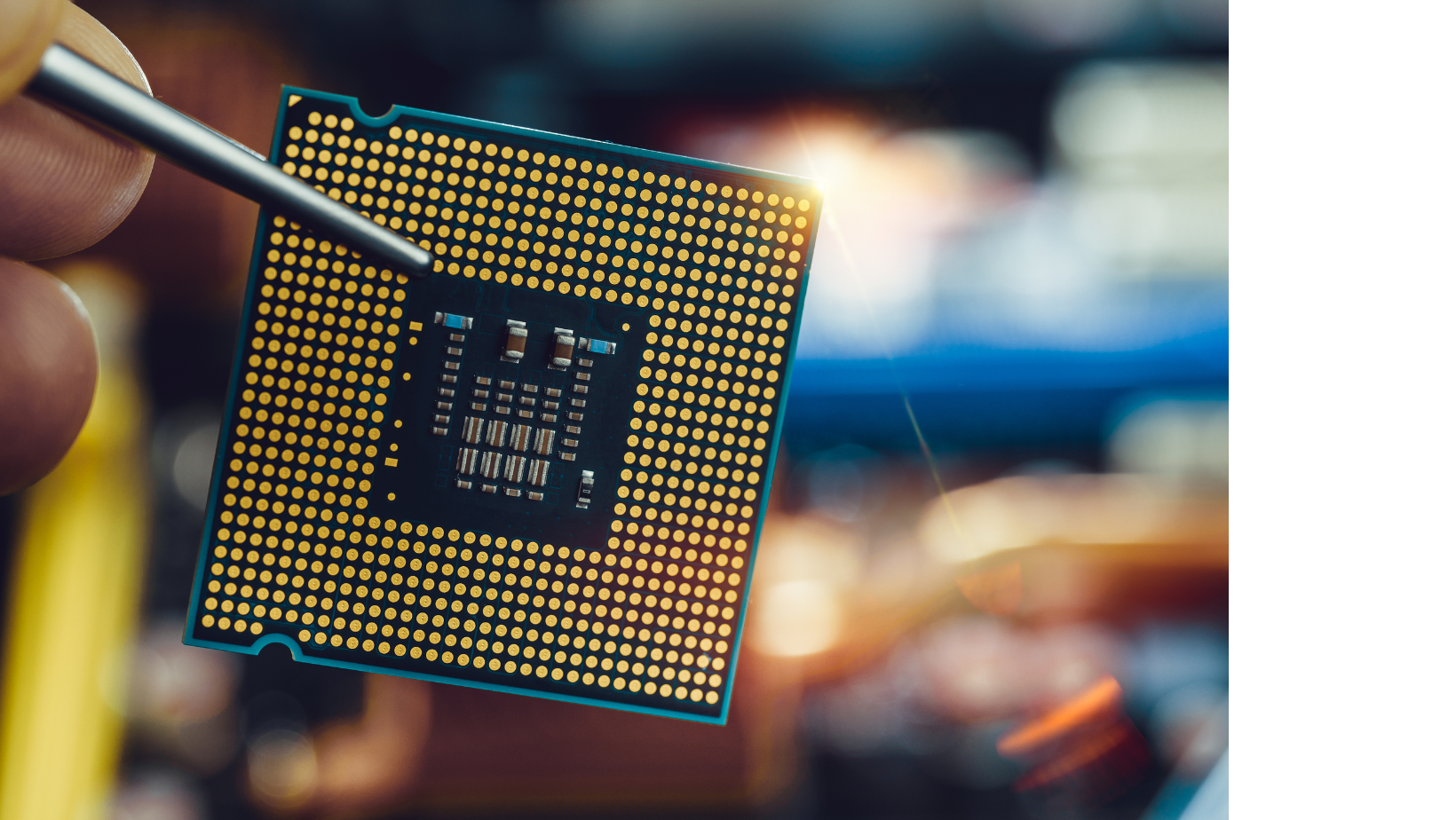

The observed trend of faster and faster devices in smaller and smaller packages can be pretty accurately summarized in an observation often called Moore’s Law. Gordon Moore, engineer and co-founder of the Intel Corporation, noticed an interesting trend in the past few decades. Computing power depends on transistors in integrated circuits, among other things, and the more transistors per circuit the more efficient the machine. To make computers faster, you need more transistors. To put more circuits in a device, your pieces need to get smaller. Increased computing power has largely been thanks to both of these trends being realized at the rate of what we call Moore’s Law: the number of transistors doubles about every two years.

As circuits get smaller and more efficient, the cost for consumers has also gone down. Although computers might not be “cheap” on the market per se, the amount we pay for computing power is orders of magnitude lower than what prices have been in the past. As these prices fall, however, another thing is on the rise: the cost of production.

The other side to this trend is the economic implication of Moore’s Law, which is to say that as chips get smaller, faster, and come into unprecedented levels of demand, production needs to keep up. This is often referred to as Moore’s Second Law, and it specifically states that the cost of a chip manufacturing plant doubles every four years.

The keen reader will have already noted that these laws, as stated, are unbounded, which is typically incompatible with reality. As such, there are two looming walls that these trends may run into very soon, and they both have to do with scalability. On one hand, there are physical limitations to just how small a processing chip can get. At some point, you can’t shrink down to or below atomic scale—and that’s not exactly an exaggeration. On the other hand, the cost of production doubling every few years is simply unsustainable.

What Role has Cryptocurrency Played?

Proximity to these technical limitations is happening during the age of crypto although, in all fairness, it would be a misdirection to claim that crypto has caused these potential issues. These trends were stated as “laws” over 50 years ago, and have been considered industry standard since then. That we are approaching these limitations during the age of crypto is more a sign of how much power contemporary technologies require, and less a relation between Moore and Bitcoin.

That being said, the age of crypto serves as an illustrative example of the dynamics described in these laws. It’s no secret that mining takes a lot of computing power—in fact, that’s the entire principle behind the security of cryptocurrencies. This computing power has never been more accessible but, as demand boomed through the crypto spike, supply had a tough time keeping up. In addition to this tension on the market, at a certain point, there are limitations to just how much computing power miners can harness while remaining decentralized, and how much traditional computing power is sustainable at all. Tradition, here, is a keyword.

The Future of the Industry

So, what happens next? Moore’s Laws implicitly lead us to see that there are physical limitations to these trends and, as such, one of two things will happen. The first is that the market will need to be checked at some point, which will likely look like a plateauing of supply and a forced stagnation of demand. There simply will not be the physical capacity to continue these trends, and they will grow as much as they can, but no more. In fact, some studies show that this stagnation has already been the nature of the market for years.

Another thing is also possible, however, and that is a revolution in computing power. There are insurmountable barriers to continuing this trend with traditional computing power, but untraditional computational power might not be subject to these same limitations—at least not at this scale. Advancements in fields like quantum computing show us promising potential that, although these limits are very real, they are not absolute. Computational power will continue to grow and, in order to do so, it must change.

Living Pono is dedicated to communicating business management concepts with Hawaiian values. Founded by Kevin May, an established and successful leader and mentor, Living Pono is your destination to learn about how to live your life righteously and how that can have positive effects in your career. If you have any questions, please leave a comment below or contact us here. Also, join our mailing list below, so you can be alerted when a new article is released.

Finally, consider following the Living Pono Podcast to listen to episodes about living righteously, business management concepts, and interviews with business leaders.